By: Allvue Team

September 12, 2022

The creation of family offices has been steeply on the rise over the last decade as wealthy families and individuals seek out their own staffs and in-house access to full wealth management needs.

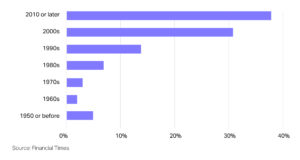

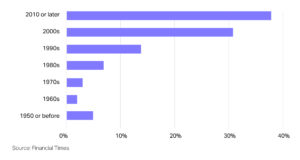

Family office growth (%)

Chart showing family offices have grown nearly 40% post-2010

But exactly what is a family office? Read on to learn about this growing group of institutional investors.

INFOGRAPHIC: Family Office Trends

Family office definition

A family office is a privately advisory firm incorporated by a high-net-worth individual or family for the purpose of managing and growing their wealth. It’s an evolution of the financial advisor role, offering a holistic approach to asset management for those with substantial investable assets.

What does a family office do?

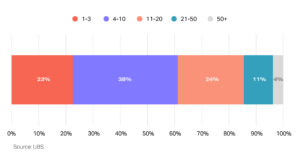

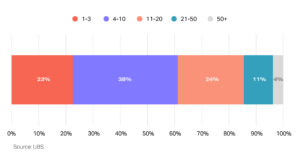

As a private wealth management advisory firm serving ultra-high-net-worth individuals (UHNWI), a family office is built to manage and grow an individual’s, a family’s, or multiple families’ assets. Most family offices employ up to 10 staff members.

Family office staff member count

This arrangement differs from a typical wealth management firm because the family can benefit from completely undivided, in-house attention from a hand-picked staff that manages all facets of wealth management, including philanthropic giving, insurance, tax planning, wealth transfer planning, and beyond.

Family offices can also operate faster and more flexibly than a typical institutional investor such as a pension fund. They have no investment board or formal mandate, and so this type of firm can be nimble, taking on different investment types and structures when needed.

What are the different types of family offices?

What is a single family office?

As the name suggests, a single family office oversees the investments and wealth management activities of a single individual or family. The staff count and portfolio structure of a single family office can vary greatly from one firm to another, and often depends on the size of the family’s assets and how they made their wealth to begin with. For example, a family who accumulated their wealth in leading a private equity firm may allocate heavier to alternative investments and private capital while a family who made their fortune over decades in the oil and gas industry might favor commodities or a more traditional investment profile in equities and fixed income.

What is a multi-family office?

A multi-family office supports multiple families’ wealth rather than just one, but still provides the full needs of managing family wealth. This type of structure is perfect for affluent families with significant net worth but who don’t quite meet the high thresholds of some single family offices. While not a regulatory requirement, many multi-family offices are registered investment advisors (RIAs). Multi-family offices can offer key cost benefits due to overhead cost and fee sharing among the families. As one entity with pooled capital to manage, they can make bigger investments (both directly and via investment managers) and potentially take advantage of smaller management fees due to larger capital commitments. This structure and cost sharing therefore makes a family office setup more accessible for families under the typical $100 million net worth threshold.

Outsourced Family Office

An outsourced family office is like having a dedicated team of financial experts at your fingertips without the hassle of managing them in-house. This model is particularly appealing to families who prefer to focus on their core businesses or passions while entrusting their financial affairs to professionals.

Embedded Family Office (EFO)

Embedded family offices, on the other hand, are established within the family’s organization. They’re like the secret sauce of successful family businesses. EFOs blend seamlessly with the family’s culture and values, providing bespoke financial solutions while maintaining an intimate connection with the family’s goals.

Who Works at a Family Office?

Behind every successful family office, you’ll find a team of dedicated professionals, including:

Tax Advisors

Tax experts are the architects behind tax-efficient structures and strategies. They ensure that your family’s wealth remains as intact as possible while complying with the intricacies of the tax code.

Lawyers

Legal professionals within a family office are responsible for estate planning, contract negotiations, and ensuring that all legal aspects of your financial affairs are in order.

Investment/Portfolio Managers

These professionals craft and execute investment strategies, keeping a watchful eye on market trends and opportunities.

What do family offices invest in?

The average family office manages $1.1 billion in assets, but a family office’s portfolio depends on the background of the family office and the family’s expertise and personal preferences.

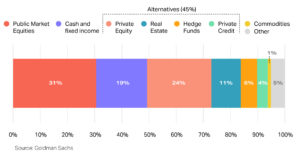

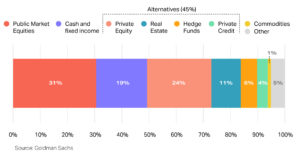

Many family offices are diversified across multiple asset classes, however. Like most of the institutional investing world, family offices are growing their involvement with alternatives as they’re drawn in by the potential for outsized returns. On average, family offices allocate 45% of their portfolio to alternatives, compared to 31% in public market equities and 19% in fixed income and cash.

As their experience in investing in these complex, illiquid assets grows, many family offices are becoming extremely adept at trading in alternatives. While many choose to invest in private equity through managers (43%), still more (54%) choose direct investing.

Family office average allocations

Chart with average family office allocations. Alts make up 45% allocation for the average family office.

READ MORE: Family Office Direct Investing Ramps Up in Private Equity

Family office average allocations

Chart with average family office allocations. Alts make up 45% allocation for the average family office.

Family Office Wealth Management Strategies

At the heart of a family office lies an array of wealth management strategies carefully tailored to each family’s unique financial landscape. These strategies go beyond the conventional, providing an exquisite blend of creativity and financial expertise. The primary goal? Maximizing returns while minimizing risks.

Multi family offices, often catering to several wealthy families, are renowned for their ability to offer economies of scale. They pool resources, share costs, and provide diversified investment opportunities that might not be accessible to individual investors.

Family Offices and Wealth Preservation

One of the hallmarks of a family office is its focus on wealth preservation. In an ever-changing financial landscape, preserving your hard-earned wealth becomes paramount. Family offices are adept at crafting strategies to ensure that your financial legacy remains intact for generations to come. They know that wealth isn’t just about the present; it’s about securing the future.

Investment Diversification

“Diversify, diversify, diversify.” It’s the mantra chanted by family offices worldwide. They understand that putting all your eggs in one basket is a risky endeavor. Instead, they strategically diversify investments across asset classes, including real estate, hedge funds, private equity, and more. This approach aims to balance risk and reward, ensuring a robust and resilient portfolio.

Tax and Succession Planning

Tax planning isn’t just about minimizing your tax bill; it’s about optimizing your financial strategy. Family offices work closely with tax advisors to develop tax-efficient structures and strategies, ensuring that your wealth stays within your family.

Succession planning is another vital aspect of family office services. It’s about creating a seamless transition of wealth to future generations. This process includes identifying potential successors, developing leadership skills, and establishing governance structures that align with your family’s values and goals.

How are family offices changing as they grow?

We’ve noted that the number of family offices has grown significantly, and, as it has, some firms are finding creative ways to take their investment experience and apply it to a larger audience to benefit the family office.

Some family offices, with plenty of experience in selecting investment managers and by investing directly, are spinning off to form their own kind of investment firm, taking on outside investors and charging fees as a way to continue growing the original family’s wealth. Fund of funds are particularly popular as a structure, allowing family office investment teams to capitalize on their experience of selecting alternative investment managers, conducting due diligence on those managers, and tracking the investment over the life of the fund.

For investors new to the complex alternative investing sphere, this skill set is appealing, as is the ability to plug into a fund of funds structure and automatically access a diversified private capital portfolio.

Do You Need a Family Office?

Deciding whether to enlist the services of a family office isn’t a decision to be taken lightly. Consider these factors:

Complexity of Financial Portfolios

The more complex your financial portfolio, the more you stand to gain from a family office. If your investments span across multiple asset classes, from real estate to hedge funds, a family office can provide the expertise to navigate this intricate landscape. Asset management and risk management become especially critical as the size of one’s investable assets increases.

Size of Your Wealth

While there’s no fixed threshold for engaging a family office, they are typically an option for high-net-worth individuals and families with substantial wealth. If you find that your wealth has reached a level where it requires careful and strategic management, it might be time to explore the benefits of a family office.

Time & Resources

Managing significant wealth is a time-consuming endeavor. If you’d rather spend your time pursuing your passions, businesses, or philanthropic endeavors, a family office can take the burden of financial management off your shoulders.

Family Dynamics

Family dynamics play a pivotal role in the decision to establish a family office. If you have multiple family members involved in wealth management decisions, a family office can provide a structured and impartial platform for decision-making.

What common challenges do family offices face?

Managing costs

The industry generally regards $100 million in assets as the threshold for considering setting up your own family office. With the costs that go into managing a family office, from staff to software, a lower net worth may not be able to cover the necessary overhead costs while still generating the needed returns. However, joining a multi-family office may be an appealing avenue if your family’s assets make up less than $100 million.

Scaling with new generations

The average family office becomes more complex as time goes on and as new generations are added to the original family and its wealth. From estate planning to taxes to investment strategy, with more voices represented in a family office, the firm will require better resources to operate smoothly. On the front office side, investment teams will require tools that enable them to access clean and organized data in order to make the best investment decisions, and in the back office, teams will require the right family office accounting solution to ensure they can delivery accurate and in-depth reporting to all family members. This brings us to your next point.

Selecting family office accounting software and investment management solutions

Management of a family office can sound daunting from multiple angles, including from operational and software perspectives. Simple and affordable solutions like Excel and QuickBooks are appealing accounting options, especially for younger family offices. But as the firm’s wealth ideally grows and your portfolio becomes more complex – especially with non-transparent alternative asset valuations – investment analysis and accounting operations can quickly spiral out of control.

Allvue’s solutions are built to take on these pitfalls of managing a modern complex portfolio and allow you to take control of your investment operations from the outset. Our asset class-agnostic Fund Accounting solution empowers family office back-office teams to optimize their accounting abilities with robust tagging abilities and a multi-currency general ledger.